What Does a Bookkeeper Do? What is Bookkeeping

Content

So, if you’re an experienced bookkeeper with a great eye for detail then this may be the opportunity for you. Our Amsterdam team is looking for a new financial Wunder that has mastered the art of accounting and is fluent in Exact Online. This Bookkeeper job description template is optimized for posting on online job boards or careers pages. Add your specific bookkeeping responsibilities to attract the most qualified candidates for your company. There are several types of accounting certifications that accountants obtain to expand their skill sets and gain positions within larger organizations. In addition to CPA credentials, other common accounting designations are chartered financial analyst (CFA) and certified internal auditor (CIA).

What skills do you need to be a bookkeeper?

- Happy working with numbers. Yep, you guessed it.

- Organisation and time management.

- Data entry and technology.

- Attention to detail.

- Communication.

- Bookkeeping knowledge and qualifications.

- Integrity and transparency.

- Problem solving and analytical.

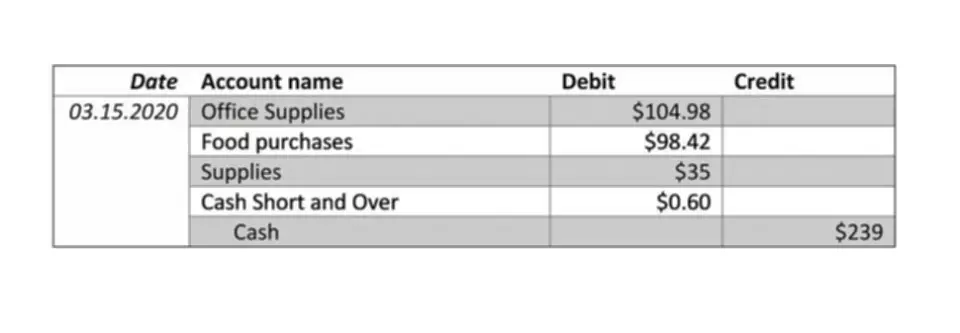

While these may be viewed as “real” bookkeeping, any process for recording financial transactions is a bookkeeping process. In the normal course of business, a document is produced each time a transaction occurs. Deposit slips are produced when lodgements (deposits) are made to a bank account. Checks (spelled “cheques” in the UK and several other what is a bookkeeper countries) are written to pay money out of the account. Bookkeeping first involves recording the details of all of these source documents into multi-column journals (also known as books of first entry or daybooks). For example, all credit sales are recorded in the sales journal; all cash payments are recorded in the cash payments journal.

Accounting software

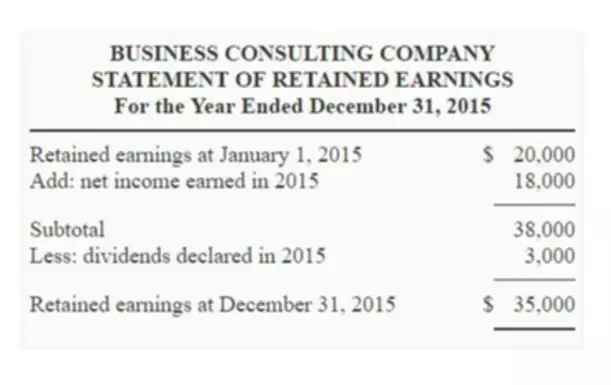

The bookkeeper brings the books to the trial balance stage, from which an accountant may prepare financial reports for the organisation, such as the income statement and balance sheet. In addition to recording financial transactions, bookkeepers also play a critical role in ensuring that a company’s finances are managed efficiently and effectively. They work closely with accountants and other financial professionals to ensure that financial records are accurate and up-to-date. Bookkeepers also monitor cash flow, manage accounts payable and accounts receivable, and prepare budgets and financial forecasts. Transactions include purchases, sales, receipts and payments by an individual person or an organization/corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems.

They also pay invoices, complete payroll, file tax returns and even maintain office supplies. https://www.bookstime.com/articles/liability-accountss handle the day-to-day tasks of recording financial transactions, while accountants provide insight and analysis of that data and generate accounting reports. Bookkeeping is the recording of financial events that take place in a company.

Job requirements

There is a difference between an accountant and a certified public accountant (CPA). Although both can prepare your tax returns, a CPA is more knowledgeable about tax codes and can represent you if you get audited by the IRS. To earn the certified public bookkeeper license, bookkeepers must have 2,000 hours of work experience, pass an exam, and sign a code of conduct.

In order to view bookkeeper accounts information online, you must be the bookkeeper for an established account with Pepper®. Regardless of the setting, bookkeepers must maintain a high level of accuracy and attention to detail. They must be able to work independently and as part of a team, and they must be able to communicate effectively with clients, vendors, and other stakeholders. Our 100% US-based team utilizes technology to manage your accounting with a personalized touch.

Advantages of a bookkeeper

However, you might hire a CIA if you want a more specialized focus on financial risk assessment and security monitoring processes. Accountants’ qualifications depend on their experience, licenses and certifications. To become an accountant, they must earn a bachelor’s degree from an accredited college or university. The rate a bookkeeper charges is based on various factors, including how much work you need done, the level of expertise you are seeking, and the state in which you do business.

In colonial America, bookkeepers would record transactions in a “wastebook”—so called because the data would eventually find its way into an official ledger and the original book would go into the trash. To facilitate quick and accurate check application, when sending payment please include the account number and invoices to be paid. Eliminate headaches and surprises by hiring our helpful team of professional accountants and bookkeepers who get back to you quickly and treat you with the respect you deserve. When interviewing for a CPA, look for an accountant who understands tax law and accounting software and has good communication skills. They should understand your industry and the unique needs and requirements of small businesses.